Checking Accounts Compared: Which One Fits Your Lifestyle

Choose the right checking account to reduce fees and enhance perks.

Published Friday, January 2, 2026 to Advice

Paying bills, buying groceries, or sending money to a friend—your checking account is at the center of it all. But not all accounts are built the same.

Some come with monthly fees, others reward your balance, and a few offer perks that can save you time and hassle. Choosing the right checking account can make your everyday finances smoother, more convenient, and even a little more rewarding.

In this guide, we’ll compare the features of different checking accounts to help you choose one that fits your lifestyle. We’ll explore Veridian’s Checking accounts to give you a clear picture.

Why Choosing the Right Checking Account Matters

Your checking account may just be the most important financial tool you have. You use it to pay bills, buy groceries, get your paycheck via direct deposit and much more.

Yet many people open the first account they see and never revisit it, even when their needs change.

Choosing a checking account that fits your current lifestyle can:

- Save you money in monthly fees or ATM charges.

- Offer better convenience with mobile tools and digital payments.

- Provide extra benefits like interest earnings or rewards.

Finding the right fit doesn’t have to be complicated once you know what to look for.

How to Choose a Checking Account

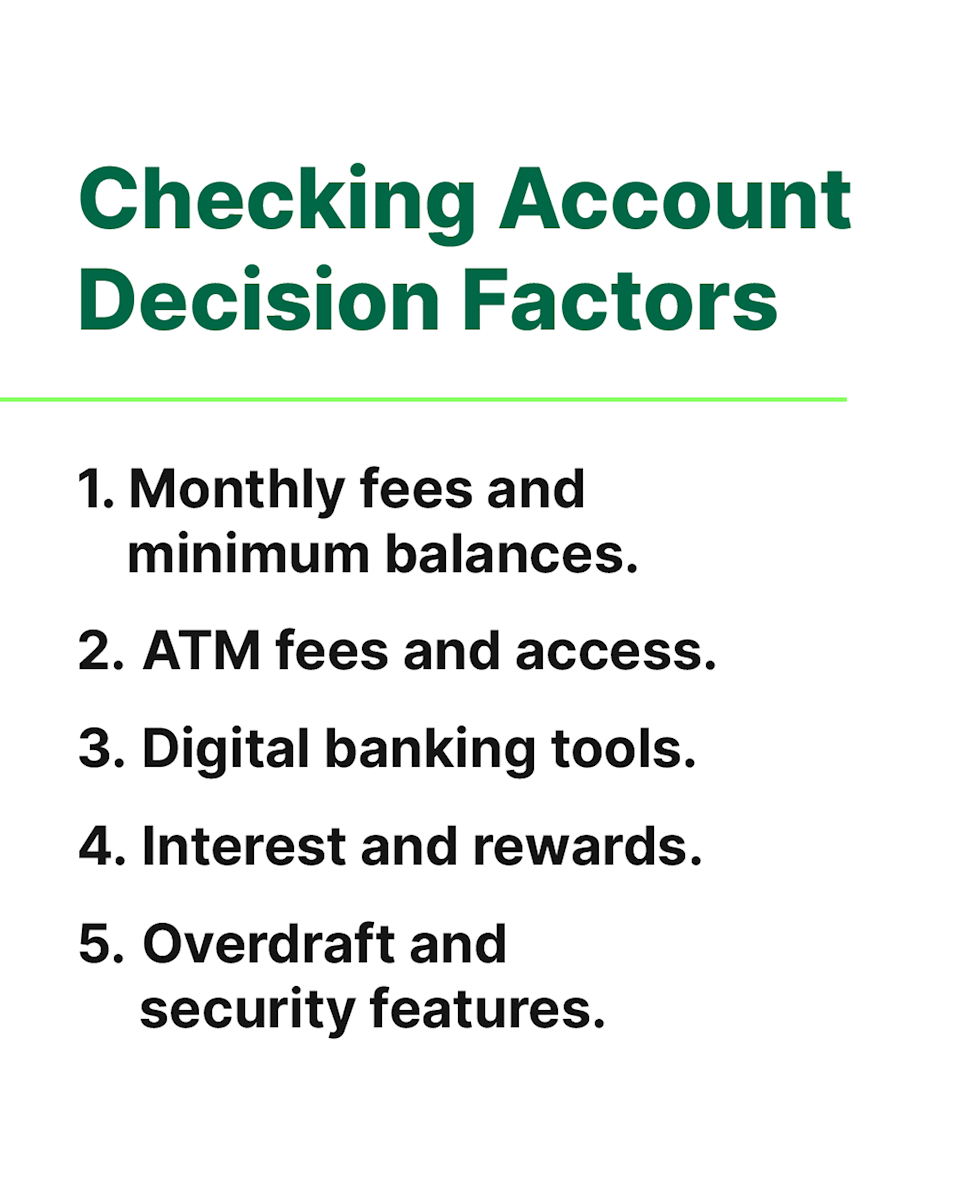

When comparing checking accounts, start by thinking about how you use your money each day. Then, look closely at the key features that make a difference:

1. Monthly Fees and Minimum Balances

Some accounts charge monthly maintenance fees unless you meet certain requirements, like maintaining a minimum balance or setting up direct deposits. If you want to avoid extra costs, look for an account that has no monthly fee or flexible ways to waive it.

2. ATM and Access Options

If you use ATMs often, look for a checking account that has a wide network of ATMs. Using ATMs in your financial institution’s network can help you save money on ATM fees. Some checking accounts also offer ATM reimbursement for a limited number of out-of-network ATM transactions.

3. Digital Banking Tools

Mobile deposits, bill pay, and instant transfers are standard conveniences now. An account that includes secure, easy-to-use online and mobile banking can save you time and make managing money simpler.

4. Interest and Rewards

Some checking accounts pay interest on your balance or offer cashback perks. These features are ideal if you keep higher balances or want to make your money work a bit harder.

5. Overdraft and Security Features

Look for options like overdraft protection, spending and balance alerts, and fraud monitoring. These small safeguards can prevent costly mistakes and help you stay on track.

Once you’ve considered these essentials, you can start comparing accounts side by side to find your best fit.

Real-World Comparison: Veridian Checking Accounts

At Veridian, we offer three checking accounts to fit different needs and lifestyles. So, we think exploring our options is a great way to demonstrate comparing the features of different checking accounts.

And here’s a spoiler… all our checking accounts have the following benefits:

- No monthly fees or minimum balance requirements.

- Free debit card.

- Online and mobile banking access.

- Large ATM network.

Free Checking

Best for: Everyday banking without extra costs.

Why it works: This account is simplicity at its finest. It’s perfect if you want a simple, worry-free account that handles your daily transactions.

Premium Checking

Best for: Members who use a debit card frequently and want to earn more on their balance.

Why it works: This account blends convenience and value. You can earn a premium interest rate on your balance when you use your debit card regularly.

Premium Plus Checking

Best for: Members who use a credit card regularly and want to earn our highest interest rate on a checking account.

Why it works: Premium Plus Checking offers our highest interest rate when you use your Veridian credit card regularly.

Which Account Fits Your Lifestyle?

When you’re deciding how to choose a checking account, think about your day-to-day habits:

- If you just need easy access to your money with no strings attached, Free Checking is likely your best fit.

- If you’re looking to earn a little more interest, Premium Checking might be the perfect balance.

- And if you manage higher balances and want to earn even more interest, Premium Plus Checking delivers more flexibility and rewards.

Your lifestyle and financial goals can shift over time, so it’s smart to review your account every year or two to make sure it still meets your needs.

Ready for a Financial Refresh?

Choosing the right checking account is one of the simplest ways to improve how you manage your money. Whether you’re looking to simplify, earn more, or upgrade your banking experience, Veridian has an option designed for you.

For more ways to organize, optimize, and feel confident about your finances, explore our Financial Refresh Guide. It’s full of practical steps to help you build healthy financial habits—starting with the right checking account.

Read: Financial Refresh Guide Explore: Free Veridian Checking Accounts