Extended Insurance Account

Secure Your Business Cash with up to $15M` in Protection.

An extended insurance account extends your NCUA insurance coverage on balances over $250,000 up to $15M` using our network of partner credit unions.

Key Benefits

Extended Insurance

Make your deposits eligible for protection in full backed by the federal government.

Single Banking Relationship

Utilize extended NCUA insurance without the hassle of multiple banking relationships.

Simple Account Opening

Accepting ModernFi's Terms & Conditions when opening the account is all that is required.

Full Transparency & Access

See allocations deposited at other credit unions in real-time and maintain control of your money.

Competitive Rates

Earn interestδ on your full balance while protecting your deposits.

How the Account Works

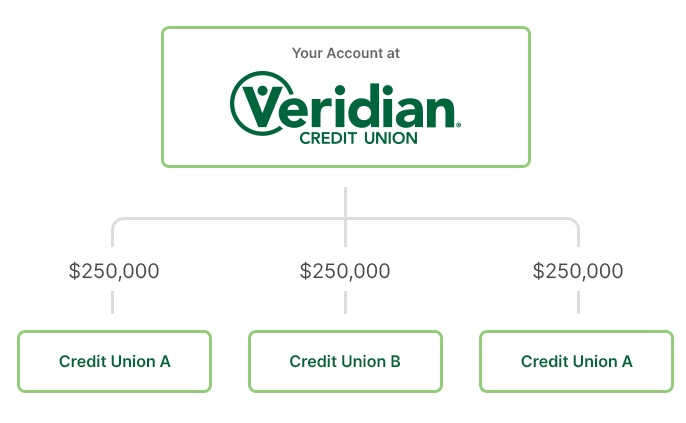

When you deposit the full amount with Veridian through an Extended Insurance Account, the money is then distributed into smaller portions across various credit unions within the network. All of these credit unions are partnered with the ModernFi Network. This allocation helps ensure that each dollar is covered by NCUA share insurance, in an amount up to the maximum of $250,000 per share owner per credit union.

Using these Extended Insurance Accounts eliminate the need to keep track of multiple accounts at various credit unions. All of your deposits and activity across your allocated credit unions are consolidated into one statement.

Questions About Extended Deposit Insurance Accounts

To fund the account, members can transfer funds from their established accounts to their newly opened Extended Deposit Insurance Account. Those funds will then be moved into the deposit network by your credit union's operations team, where they can be withdrawn upon request.^

The NCUA insures deposits up to $250,000 per share owner per credit union. Deposit networks automate distributing funds to multiple NCUA-insured institutions, keeping balances under the limit to ensure full coverage. Deposits remain protected by the NCUA and backed by the U.S. government through the NCUSIF. While ModernFi is not an NCUA member, all partner credit unions are.

Extended Deposit Insurance Accounts offer robust security, safeguarding funds up to $250,000 per member at each participating credit union through NCUA insurance. Since 1970, no member has lost NCUA-insured funds due to a credit union failure.

In the rare event of a failure, the NCUA settles deposit claims, and funds are typically disbursed within a few business days. ModernFi ensures all necessary filings are completed for prompt payment.

You can only access your Program Deposits through your relationship with the Credit Union, which then works with ModernFI and the Custodian Bank to deposit funds to, and withdraw funds from, the Program through a deposit account held for your benefit.

How to Get Started

Open an Extended Insurance Account

Contact us

Stop by, schedule an appointment with a business advisor or submit a request form to be contacted.

Fund Account

You can even open your Extended Insurance Account with $0.

Enjoy Extended Coverage

Let your savings grow with the comfort of knowing your funds are federally insured.